54+ how much of your monthly income should go to mortgage

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Principal interest taxes and insurance.

How Much A 250 000 Mortgage Will Cost You Credible

Web For example say your gross monthly income is 6000 and you have 2000 in debt payments each month across your mortgage auto loan and student loans.

. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. Keep your total monthly debts including your mortgage. Web The Bottom Line.

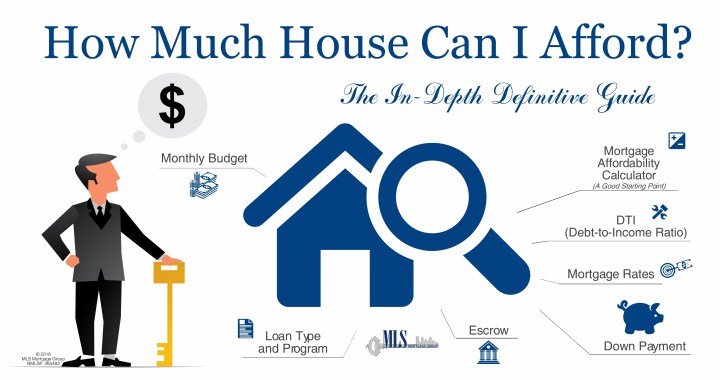

Compare offers from our partners side by side and find the perfect lender for you. Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Ad See how much house you can afford.

Web The 3545 Model. Lock Your Mortgage Rate Today. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general you shouldnt pay more than 28 of your income to a house payment though you may be approved with.

Apply Now With Quicken Loans. Never spend more than 25 of your monthly take-home pay after tax on monthly mortgage. Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the.

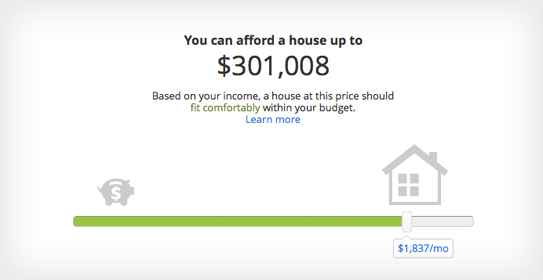

Ad Calculate Your Payment with 0 Down. But with a bi-weekly. Web To calculate how much house you can afford use the 25 rule.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. The 28 rule isnt universal. Web Lets say you use the calculator to determine you can afford a home up to 275000.

Web This means that if your household brings in 4000 a month your mortgage payments should be no more than 1000. Some financial experts recommend other percentage models like the 3545 model. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Were not including additional liabilities in estimating the. For example if you pay 1500 a month. Ideally that means your monthly.

Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad Compare Mortgage Options Calculate Payments.

A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Save Time Money. Keep your mortgage payment at 28 of your gross monthly income or lower.

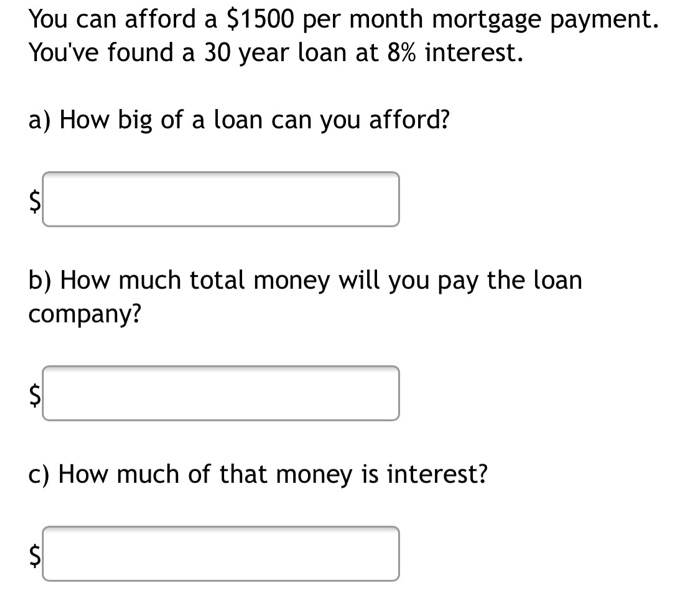

Using this price if your credit score is 580 or higher youll need 9625 for. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. And they see a 28 DTI as an excellent one.

Web 25 Post-Tax Model. Of course if you are able to spend less than. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Web Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. Were Americas Largest Mortgage Lender. Thats a mortgage between 120000 and.

This rule says you. Estimate your monthly mortgage payment.

Here S How To Figure Out How Much Home You Can Afford

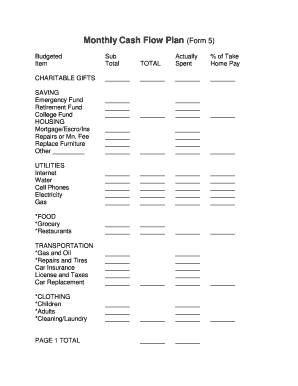

54 Free Editable Monthly Plan Templates In Ms Word Doc Pdffiller

What Percentage Of Your Income To Spend On A Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

54 Free Editable Monthly Plan Templates In Ms Word Doc Page 6 Pdffiller

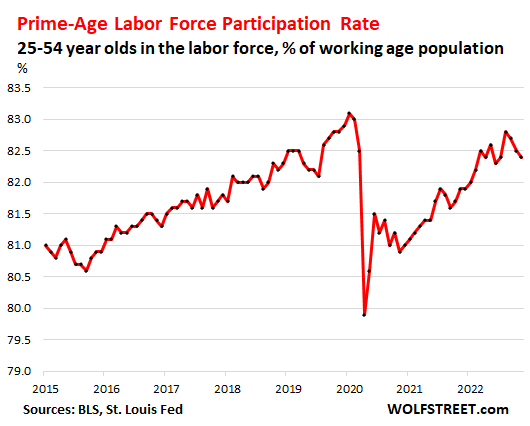

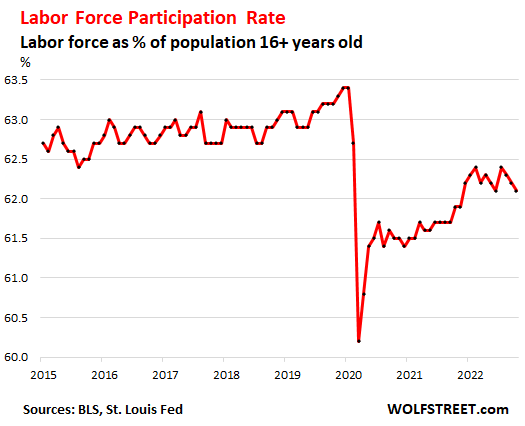

The Jobs Report In Light Of What Powell Said The Fed Cannot Create Supply Of Labor But It Can Slow The Demand For Labor Wolf Street

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Percentage Of Income For Mortgage Payments Quicken Loans

The Jobs Report In Light Of What Powell Said The Fed Cannot Create Supply Of Labor But It Can Slow The Demand For Labor Wolf Street

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

What Percentage Of Your Income Should Go To Mortgage Chase

Loan Dsa Partner Registration 3 50 Payout Paisapaid Com

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Affordability Calculator How Much House Can I Afford Zillow

Solved You Can Afford A 1500 Per Month Mortgage Payment Chegg Com

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

How Much Home Can You Afford Advanced Topics